Sports Development Act 1997 Tax Relief

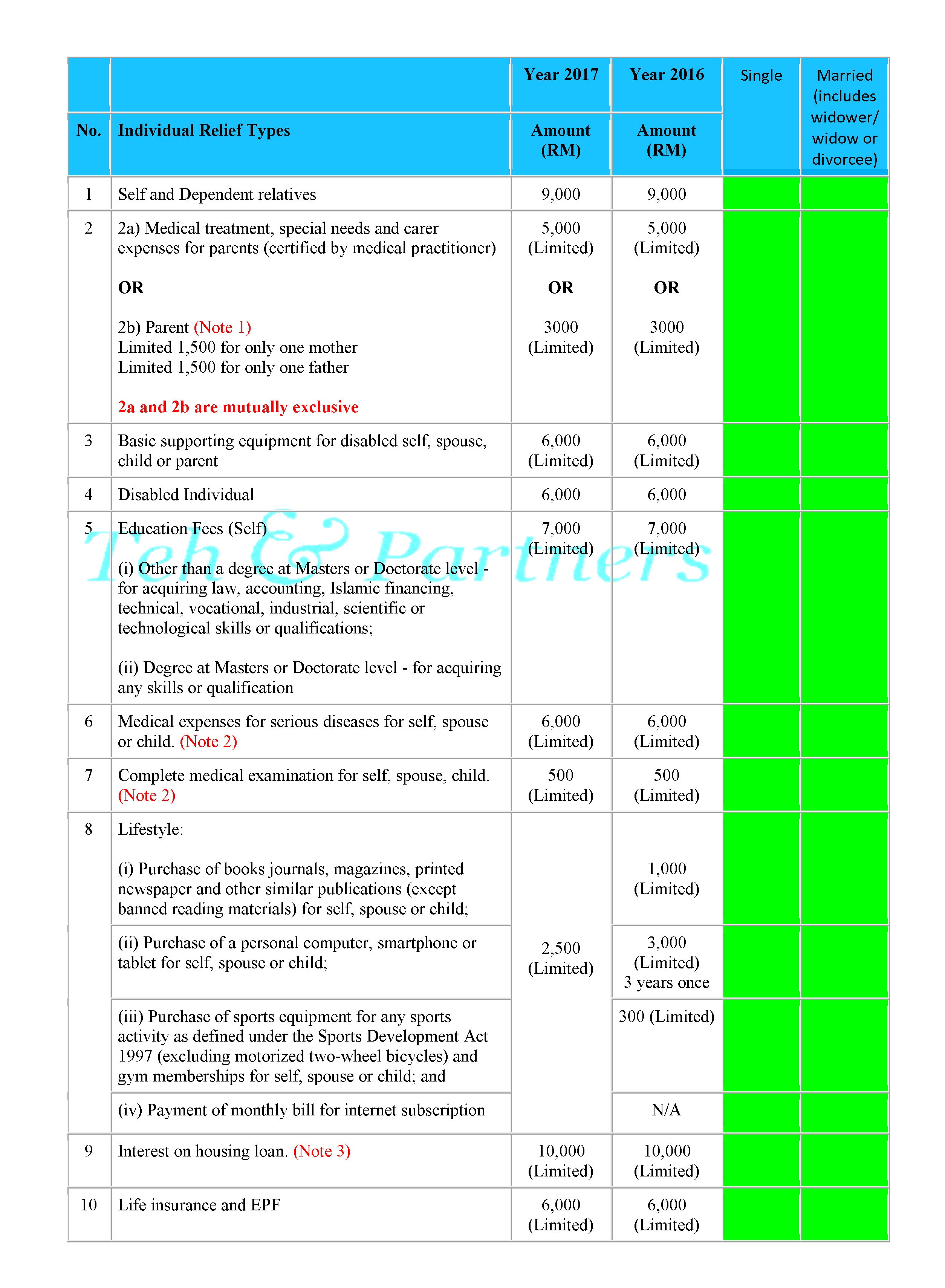

However with the new lifestyle relief she would have gotten only rm2 500 in tax relief despite the added categories.

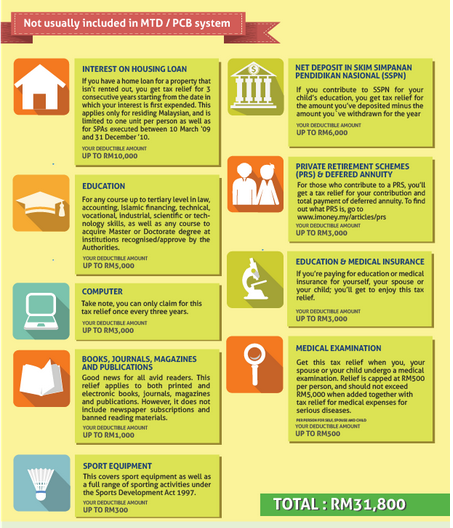

Sports development act 1997 tax relief. 1 000 limited net saving in sspn. Rm 2 500 including. The term equipment is not defined and is thus open to discussion. Iii purchase of sports equipment for any sports activity as defined under the sports development act 1997 excluding motorized two wheel bicycles and gym memberships for self spouse or child.

A 279 2004 sports development amendment 13 08 2004 order 2004 28 laws of malaysia act 576. Purchase of sports equipment for any sports activity as defined under the sports development act 1997 excluding motorised two wheel bicycles and gym. And iv payment of monthly bill for internet subscription. This part has been a point of confusion and contention when it comes to claiming tax relief for sports equipment.

Lhdn states in the income tax act that the tax relief for sports equipment is only eligible for those used in sporting activities defined in the sports development act 1997. Iii purchase of sports equipment for any sports activity as defined under the sports development act 1997 excluding motorized two wheel bicycles and gym memberships for self spouse or child. Total tax relief for these categories. The previous laptop books stationary and sports equipment tax relief is now grouped under lifestyle tax too.

Iii purchase of sports equipment for any sports activity as defined under the sports development act 1997 exclude motorized two wheel bicycle and gym memberships for spouse. Types of reliefs purchase of sports equipment for any sports activity as defined under the sports development act 1997 not eligible for the purchase of sports clothing and shoes housing loan interest amount limited to a. The provision available for this tax relief under income tax act is as follows. A 170 1998 sports development modification 01 04 1998 order 1998 p u.

Act 576 sports development act 1997 list of amendments amending law short title in force from p u. From the year 2008 individual taxpayers are allowed to claim tax deduction of up to rm300 a year on purchase of equipments for sports as defined by the sports development act 1997. Even without including the new categories lee will be able to get relief of rm3 000 rm2 400 rm600 based on the current separated tax reliefs. Tax relief rebate eduction income credit end year of assessment 2015 malaysia www hasil gov my lembaga hasil dai.

Tax relief of up to myr 300 for the purchase of sports equipment for sports activities as defined under the sports development act 1997. This means equipment like footballs shuttlecocks nets rackets martial arts weapons fencing swords. 2 500 limited purchase of breastfeeding equipment. And iv payment of monthly bill for internet subscription.

And tax relief of up to myr 3 000 for the purchase of a computer to be claimable once over a three year period. Purchase of breastfeeding equipment.