Minimum Salary In Malaysia To Pay Income Tax

If you own a business that is a tax resident company in malaysia meaning that its management and control are exercised in malaysia then you will be liable to pay corporate income tax.

Minimum salary in malaysia to pay income tax. Your average tax rate is 15 12 and your marginal tax rate is 22 50 this marginal tax rate means that your immediate additional income will be taxed at this rate. Tax rates are on chargeable income not salary or total income. You must pay income tax on all types of income including income from your business or profession employment dividends interest discounts rent royalties premiums pensions annuities and others. The employment income of non residents is taxed at the flat rate of 15 or the progressive resident tax rates see table above whichever is the higher tax amount.

This is also known as the take home pay. In malaysia minimum wage refers to lowest gross wage per month and it does not apply to apprentices and domestic servants. According to section 45 of malaysia s income tax act 1967 all married couples in malaysia have the right to choose whether to file individual or joint taxes. If you make rm 70 000 a year living in malaysia you will be taxed rm 10 582 that means that your net pay will be rm 59 418 per year or rm 4 952 per month.

The minimum wage was was announced in october 2010 and introduced in january 2013 as one of the government s policy instruments vide new economic model nem to ensure inclusiveness by transforming the economy from a middle income to a high income economy by the year 2020. The gazette states that the minimum wage rates payable for those outside the listed areas will be rm5 29 an hour or rm1 100 per month with the rates payable for a four five and six workday. Resident companies are taxed at the rate of 24 while those with paid up capital of rm2 5 million or less are taxed 18 for their first rm500 000 and 24 for earnings in exces of rm500 000. All individuals who derive income from their investments in property shares unit trusts fixed deposits etc.

Net salary per month is the total amount of salary calculator remaining after the total deductions are made on the employee s gross monthly salary. First off we start with the table for personal income tax rates in malaysia for the assessment year 2015 so everyone would be able to cross check the tax bracket and the amount of tax needed to pay. Any individual earning more than rm34 000 per annum or roughly rm2 833 33 per month after epf deductions has to register a tax file. As a general rule of thumb if both spouses are earning high incomes in the year of assessment it is always recommended to opt for separate assessment to leverage on the tax reliefs and deductibles available.

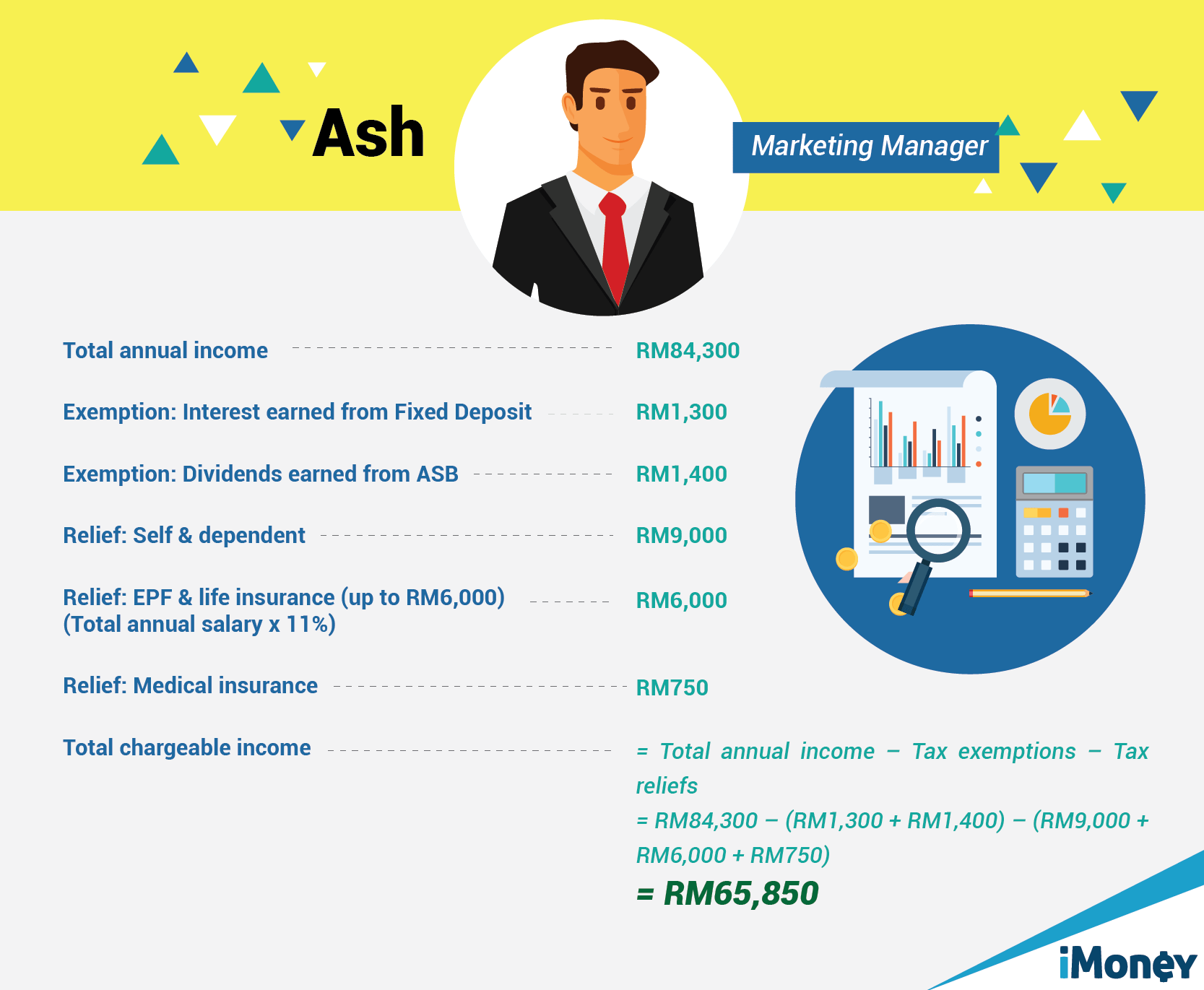

Annual salary is the total amount of gross salary calculator earned by an employee on an annual basis before any deductions are made for epf socso and income tax. Chargeable income is calculated after tax exemptions and tax reliefs more below. Taxes on employment income.