Income Tax Calculator Malaysia 2019 Excel

Calculations rm rate tax rm 0 5 000.

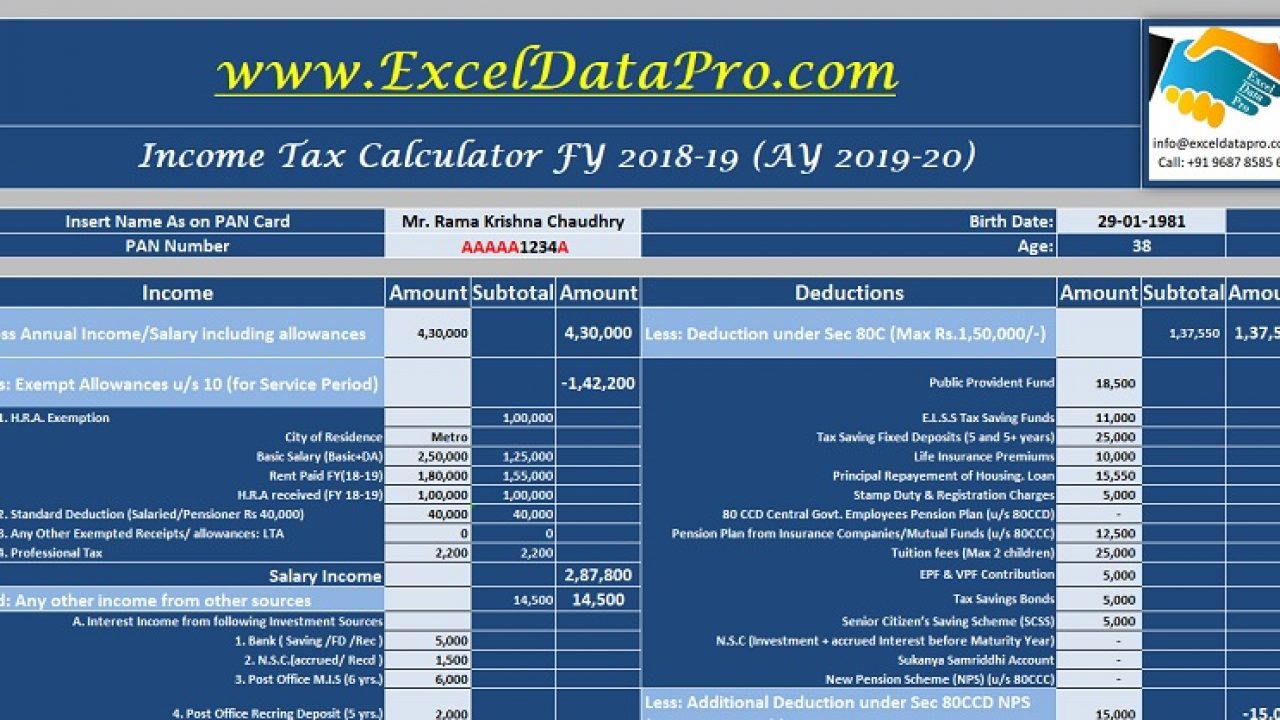

Income tax calculator malaysia 2019 excel. This excel based income tax calculator can be used for computing income tax on income from salary pension gifts fixed deposit and bank interest house rent and capital gains short and long term gains. As a general rule of thumb if both spouses are earning high incomes in the year of assessment it is always recommended to opt for separate assessment to leverage on the tax reliefs and deductibles available. On the first. Review the full instructions for using the malaysia salary after tax calculators which details malaysia tax.

Income tax calculator for tax resident individuals. The annual wage calculator is updated with the latest income tax rates in malaysia for 2019 and is a great calculator for working out your income tax and salary after tax based on a annual income. The calculator is designed to be used online with mobile desktop and tablet devices. Home income tax rates.

According to section 45 of malaysia s income tax act 1967 all married couples in malaysia have the right to choose whether to file individual or joint taxes. The deadline for filing your income tax returns form in malaysia varies according to what type of form you are filing. Excel based income tax calculator for fy 2019 20 ay 2020 21. Calculations rm rate tax rm 0 5 000.

Your average tax rate is 15 12 and your marginal tax rate is 22 50 this marginal tax rate means that your immediate additional income will be taxed at this rate. Ya 2020 xls 96kb new. For the be form resident individuals who do not carry on business the deadline for filing income tax in malaysia is 30 april 2020 for manual filing and 15 may 2020 via e filing. Determine when your business is liable for gst registration for periods prior to 2019.

Headquarters of inland revenue board of malaysia menara hasil persiaran rimba permai cyber 8. On the first 5 000.