Epf Employer Contribution Rate 2019 Malaysia

So below is the breakup of epf contribution of a salaried person will look like.

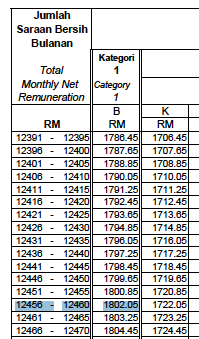

Epf employer contribution rate 2019 malaysia. 8 33 of 20000 inr 1 666 employer s epf contribution is epf eps. Monthly contribution rate third schedule the latest contribution rate for employees and employers effective january 2019 salary wage can be referred in thethird schedule epf act 1991 employers are required to remit epf contributions based on this schedule. Failing to submit within the stipulated period will result in a late penalty charged by kwsp. Effective from january 2018 the employees monthly statutory contribution rates will be reverted from.

At the same time the employees share of minimum contribution rate has been reduced to 0 down from the previous 5 5 this was announced by the epf also known as kwsp kumpulan wang simpanan pekerja on 7. 12 of 20000 inr 2 400. The malaysian government has reduced the minimum employee contribution rate for the employees provident fund epf to 7 starting from april 1 in a bid to cushion the impact of the covid 19. Members of the employees provident fund epf earning a monthly wage of not exceeding rm5 000 will be receiving a boost in their retirement savings when the revised employers statutory contribution rate of 13 percent takes effect from january 2012 wages.

Your mandatory contribution is calculated based on your monthly salary as an employee in accordance with the contribution rate third schedule monthly contributions are made up of the employee s and employer s share which is paid by the employer through various methods available to them. 1 12 of employees share in epf i e. 2 3 67 of employer s share in epf of 20000 inr 734. 3 8 33 of employer s share in eps i e.