Disposal Of Asset Under The Real Property Gains Tax Act 1976 Yes Or No

3 order 2018 p u.

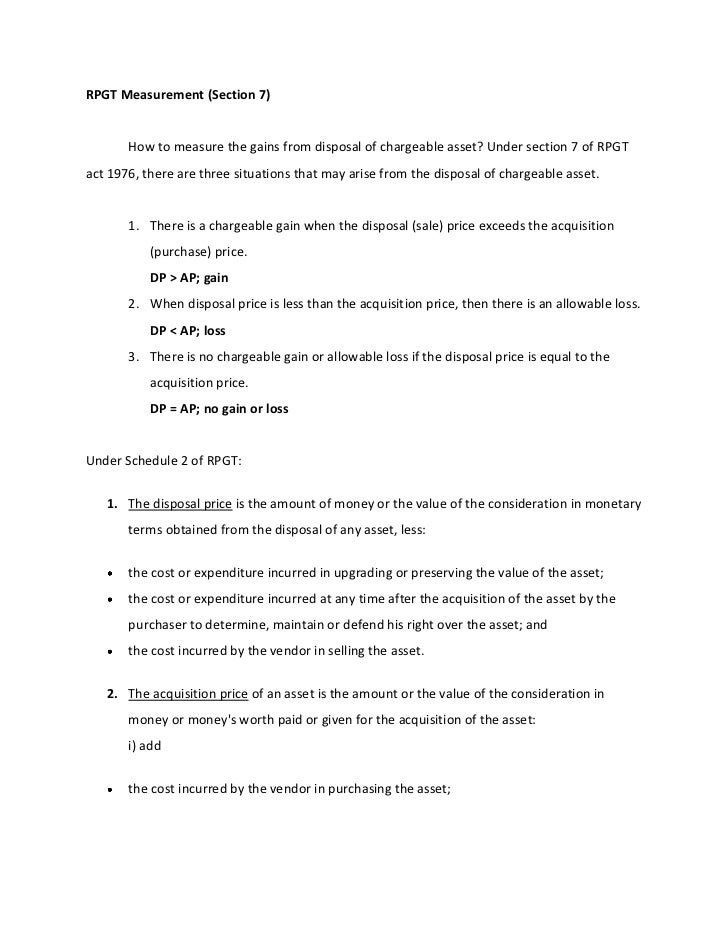

Disposal of asset under the real property gains tax act 1976 yes or no. Based on the real property gains tax act 1976 rpgt is a tax on chargeable gains derived from the disposal of property. A chargeable gain is a profit when the disposal price is more than the purchase price of the property. 2 subject to this act the tax shall be charged on every ringgit. A there have been no changes to the rpgt rates under the budget 2015 announcement.

Under the real property gains tax act 1976 rpgt act an rpc is a controlled company which the defined value of its real property or shares in another rpc or both is at least 75 of the value. The disposer and the acquirer are exempted from completing and submitting the relevant disposal and acquisition forms if the disposal of the assets subject to the income tax act 1967. Transfer of assets by way of gift between 1 husband and wife 2 parent and child 3 grandparent and grandchild gains on disposal of one private residence only for a malaysian citizen or permanent resident. 1 a tax to be called real property gains tax shall be charged in accordance with this act in respect of chargeable gain accruing on the disposal of any real property hereinafter referred to as chargeable asset.

The rpgt is applicable for individual and companies. The rpgt act 1976 allows certain incidental costs of the acquisition of the property and disposal of the property to be taken into account. A 372 under this exemption order a malaysian citizen or a permanent resident in malaysia will be exempted from real property gains tax on the chargeable gain for the disposal of a chargeable asset other than shares if the following conditions are fulfilled. Real property gains tax act rpgt 1976.

This is clearly spelt out under the real property gains tax rpgta 1976 which only imposes tax on chargeable gain accruing on the disposal of any real. What most people don t know is that rpgt is also applicable in the procurement and disposal of shares in companies where. Real property gains tax exemption no. Real property gains tax exemption order 2011 5 2 2 where the disposal of a chargeable asset is made in the sixth year after the date of acquisition of such chargeable asset or any year thereafter the minister exempts any person from the application of schedule 5 of the act on the payment of tax on the.

Real property gains tax act rpgt 1976 is tax charged by the lhdn on gains derived from the disposal of property. In the absence of a written agreement the date shall be taken as the earlier of full payment of the purchase consideration or the date when all things which is necessary for the transfer of ownership of the real property under any written law has been done. Understanding how real property gains tax. Rpgt is a tax chargeable on the profit gained from the disposal of a property and is payable to the inland revenue board.

The date of disposal is taken as the date of the written agreement of the disposal.