Director Fees Taxation Malaysia

I 39 ve run a sdn bhd company since last year.

Director fees taxation malaysia. Registered financial planner rfp shariah registered financial planner shariah rfp registered financial planner rfp capstone programme. Interest arising in a contracting state and paid to a resident of the other contracting state may be taxed in that other state. A will the taxation be triggered irrespective of whether or not the board member is physically present at the board meetings in malaysia. A withhold tax i remuneration received as board director of 10 000 approved on 3 jun 2019 withhold and remit tax of 2 200 10 000 22 by e filing the withholding tax by 15 aug 2019 as the physical presence of the director in singapore was less than 183 days from 1 jan 2019 to 3 jun 2019.

We have steady monthly 5 figure business profit. Say in a mum and dad company we cannot really pay mum a salary and wage as she is normally a non working director of the company. En nice and easy. Yes where director fees is received.

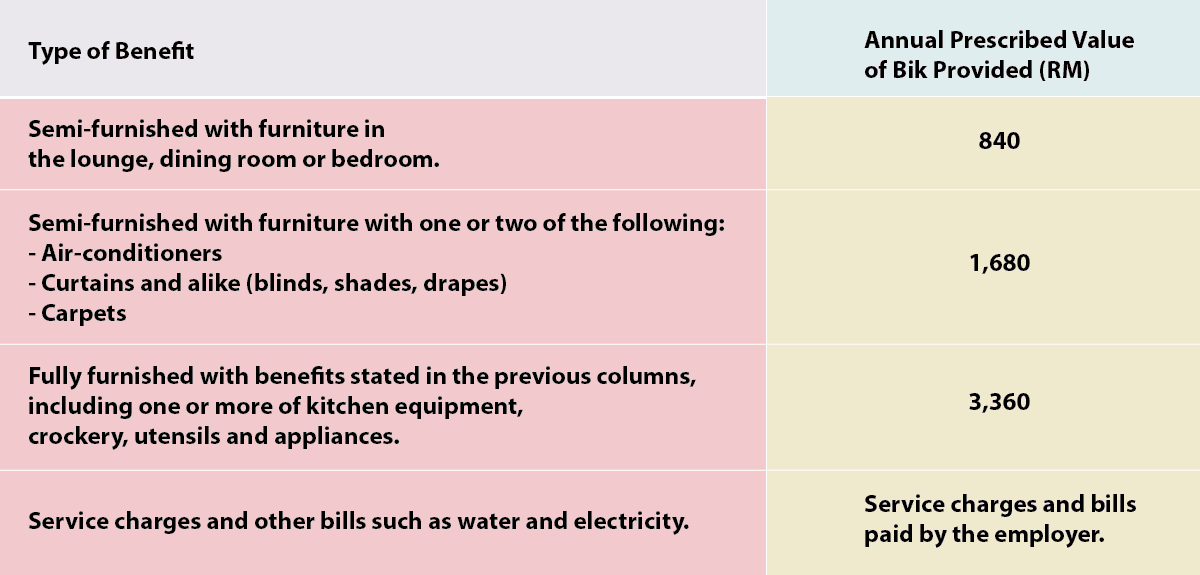

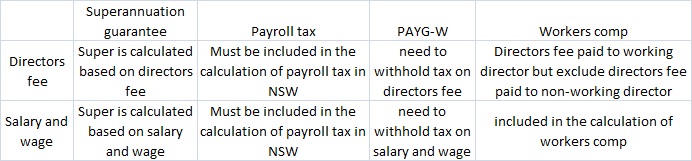

However we can pay her a 5000 directors fee at the end of year no superannuation guarantee no payroll tax as the company payroll is not big enough no payg w and no workers comp. Between relatives directors fees effective from year of assessment 2015 a person entitled to receive any gross income. Confirmation of payment cp letter will be issued to the employer. Director fee or any remuneration received by a statutory director from a company resident in malaysia with respect to their directorship is liable to malaysian tax.

Malaysia also follows single tier taxation therefore dividends in the hands of the recipients are tax free. We are in equal share stake 50 50. No director s fees are assessed in the year that a director received the payments. Would director s fees declared to a non resident director by a malaysia incorporated company but not remitted to the director subject to withholding tax.

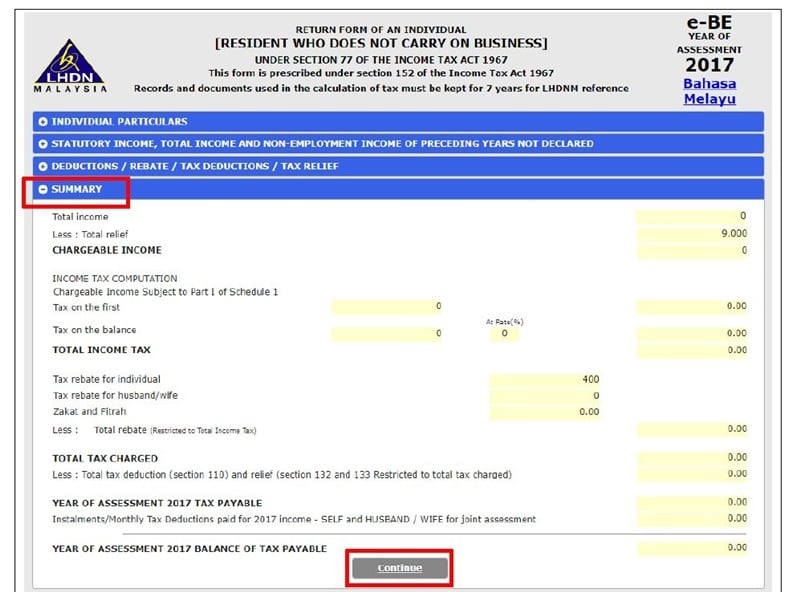

Average lending rate bank negara malaysia schedule section 140b restriction on deductibility of interest section 140c income tax act 1967 study group on asian tax administration and research sgatar. Direct taxation in malaysia is based on the unitary system and the basis of taxation is. Director s fees approved in arrears the company voted and approved director s fee of 20 000 on 30 jun 2019 to be paid to you for your service rendered for the accounting year ended 31 dec 2018. Now we are planning to have payout from company as we didn 39 t draw a single cent since beginning.

Hence the earliest date on which the director is entitled to the director s fees is the date the fees are voted and approved at the company s agm.