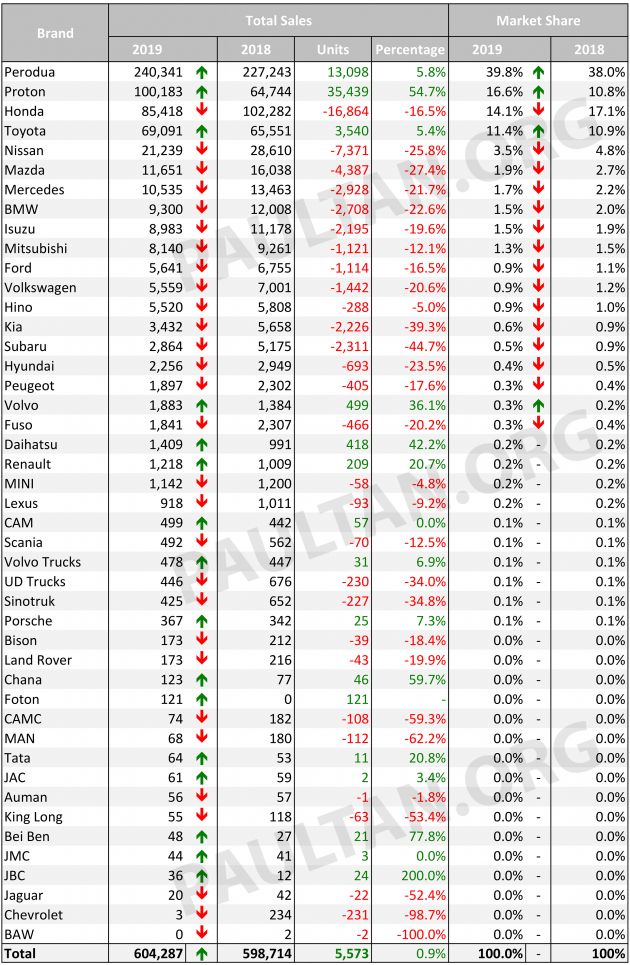

Benefit In Kind Motor Vehicles Malaysia 2019 Table

Inland revenue board of malaysia benefits in kind public ruling no.

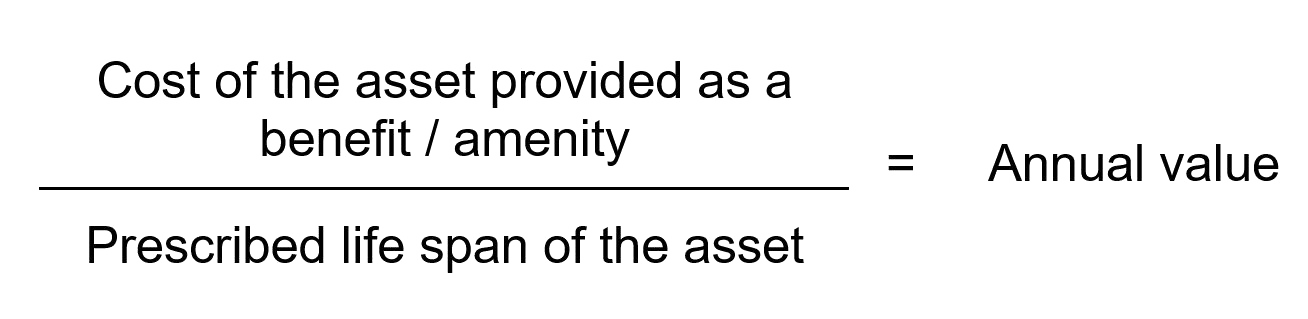

Benefit in kind motor vehicles malaysia 2019 table. Relevant provisions of the law 1 3. 15 march 2013 pages 3 of 31 b any appointment or office whether public or not and whether or not that relationship subsists for which the remuneration is payable. Motor cars provided by employers are taxable benefit in kind. Benefits in kind superceded by the public ruling no.

11 2019 date of publication. 3 4 motorcar means a motor vehicle other than a motor vehicle licensed by the. This section is only applicable where ownership of the car does not transfer to the employee. 8 2019 6 12 2019 refer year 2019.

The tax treatment in relation to benefit kind bik received by an employee from his s in employer for exercising an employment. Benefits in kind 2 5. Superceded by the public ruling no. Company car tax payable by an employee is based on the vehicle s p11d value multiplied by the appropriate bik rate determined by the car s co2 and fuel type and the employee s income tax rate basic rate of 20 higher rate of 40 or additional rate of 45.

2 2004 date of. 3 2013 date of issue. A translation from the original bahasa malaysia text page 1 of 15. Perquisites means benefits that are convertible into money received by an.

11 2019 12 12 2019 refer year 2019. Benefits in kind public ruling no. List of benefits in kind granted administrative concession or exempt from tax. Tax treatment of various car and car related benefits summary table.

Table of contents 2018 2019 malaysian tax booklet 5. Inland revenue board of malaysia benefits in kind public ruling no. Particulars of benefits in kind 4 7. Total value of taxable car benefit from 1 january 2019 to 31 december 2019 1 420 6 196 7 616.

Ascertainment of the value of benefits in kind 3 6. If you transfer the car to your employee general bik rules shall apply. So going back to questions 1 the benefits on the value of private use of the car and petrol provided is benefit in kind and taxable to the person receiving the benefit. For the employee the benefit in kind bik is then taxed at the appropriate personal tax rate usually collected through paye.

12 december 2019 contents page 1. Motor cycles less than 410kg. Vans see private use of company vans vehicles not commonly used as a private vehicle and unsuitable for such use such as hearses and lorries. 2018 2019 malaysian tax booklet 7 scope of taxation income tax in malaysia is imposed on income accruing in or derived from malaysia except for income of a resident company carrying on a business of air sea transport.